Hiring good project managers is critical to any business’ success, yet so many companies are going about hiring them in all the wrong ways. Russell Harley provides us with five simple, cost-effective ways to ensure you are hiring the right project manager for your business. Picking the right or wrong applicant for your company’s needs can make or break your company. If hirers take these five simple measures- they will be far more likely to hire a great project manager that will better the company.

Stop Using Generic Job Descriptions

It seems as though every job description/qualifications section for a project manager job application is a broad template that could be applied to just about any position or company. “Must have good communication skills,” “Be a self-starter,” and “Work well with teams” are all examples of what you will see in just about every job description for a project manager position. In order to find the right person for the position- these need to be more specific to what the company values and expects from the candidate. Such broad language will invite hoards of applications into your inbox, turning your hiring process into a “needle in a haystack” type of task. You are more likely to get responses from project managers that are a good fit for your company when you clearly specify what is expected of the person. Not only will these generic job descriptions hinder your company’s hiring process, but is also not fair for the applicant to come into a position that they are not prepared/qualified for.

Decide Exactly What You Need

Doing this is really just another way to narrow down your pool of applicants. Prepare an in-depth analysis of what aspects of your company struggles with and needs improvement. For example, if your company is struggling with the adoption of a new type of software, ask for knowledge and experience using that specific type of software. This will cut down on training time/costs and help your company operate more efficiently.

Critical Projects Need Dedicated Project Managers

With cost-cutting being a reoccurring measure taken by almost all companies- it is important to get the most bang for your buck when hiring a project manager. Sure, the overseeing and delegation aspect of project management is very important, but you also want a project manager that is willing help out with the workload. Having a project manager that is willing to get his hands dirty will earn the respect of team members and increase efficiency. Make sure to find a project manager that doesn’t want to just sit a desk all day; find one that is willing to do whatever it takes get a project done the most efficient way possible.

If You Need a Specific Methodology Used, Say So

Some project managers favor certain methods for getting a project done and not all of them will work for what you need done. Make sure you know what methods of management your employees respond best to and that the project manager you hire is familiar and experienced with those methods. Using a methodology that your employees do not respond well too can cause a project to fail quicker than almost anything.

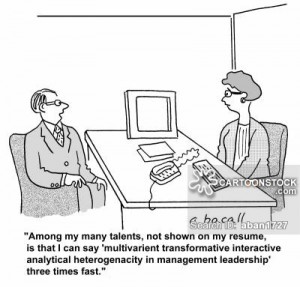

Eliminate the Essay Questions

It is very common for companies to ask for written responses from job candidates answering questions like “What makes you a good leader?” Nine times out of ten you are going to get a fluffed up response with little merit. Going through all of these responses can be a lengthy, time-consuming process. Look to their experience and references- that should answer just about any essay question you are thinking about putting on an application.

Do you agree/disagree with Harley’s suggested practices in the project manager hiring process?

Thanks for reading.

http://www.forbes.com/sites/groupthink/2014/05/07/how-to-hire-a-great-project-manager/