These days it feels like every tech company is trying to get inside your living room. In years past it has been the cable companies who have had a major hold but as streaming services like Netflix and Hulu Plus are becoming much more accessible and a TV war is looming. One company trying to merge the cable and streaming industry is Fanhattan.

Leading up to now having both services is often a very conflicting proposition. Not only do you have to pay for two separate services, but it is such hassle to switch between them. If you are watching a sports game with cable but you want to switch to Netflix to watch a movie, you have to change the inputs on your TV and (if applicable) your surround sound. And if you would ask my parents to do that, they’d rather do open heart surgery than learn how TV inputs work.

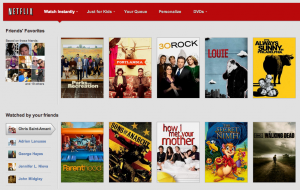

Over the past few years Fan TV has designed and built a product that should remedy these issues. They have made their own set top box that connects straight to the internet and will allow you to run both cable and streaming services off one box. Not only will this make switching between the two much easier but it will also give you the ability to only have one box next to your TV. Another one of the company’s goals is to make finding programing easier. If you think about how cable companies have their channels set up now, it is just organized by a giant list of channels that you have to scroll through to get to the channel you want to watch. With Fan TV you can set it up like that, or more how Netflix and Hulu do it, which is sorting based on programming. Also if you were watching normal TV and wanted to switch to Netflix, the transition would be seamless.

The biggest hurdle that faces Fan TV is if they can get the cable companies to provide an internet stream of their content. They have not announced who their partners might be but I think it is in the best interest of the cable companies to adopt something new and fresh since they have had roughly the same type of box for the past 10 years, while their streaming competitors have been innovating much more.

Obviously one of the biggest indicators of quality is customer specifications and one of the qualities that customers look for these days is innovation. Clearly over the past 10 years the TV landscape has changed dramatically and it has been the new streaming services that have been the biggest innovators. Hopefully Fan TV can work with the cable companies to solve this issue and become more appealing to their demanding customers.

Do you think that cable companies are lacking compared to newer streaming services?

Do you think something like Fan TV could help keep cable companies current? Sources:

http://www.theverge.com/2013/5/30/4380108/fantv-set-top-box-fanhattan

http://www.usatoday.com/story/tech/2013/05/30/new-fan-tv-control/2372721/

As you all may know, Redbox kiosks have been a great sensation to today’s generation. It started as a box kiosk filled with movie options to rent for only $1/night. People loved the idea of not having to have a traditional movie store card/membership in order to rent out movies. The locations of most of the kiosks are very easy to find and most of the time are located in places where you might stop for other errands as well. According to the Gadget Review, by the end of June 2011, Redbox had 33,000 kiosks in about 27,800 locations. It was everywhere!

As you all may know, Redbox kiosks have been a great sensation to today’s generation. It started as a box kiosk filled with movie options to rent for only $1/night. People loved the idea of not having to have a traditional movie store card/membership in order to rent out movies. The locations of most of the kiosks are very easy to find and most of the time are located in places where you might stop for other errands as well. According to the Gadget Review, by the end of June 2011, Redbox had 33,000 kiosks in about 27,800 locations. It was everywhere!