With Netflix all but eliminating video rental stores, nationwide (with an assist from Redbox), and Hulu’s presence as an online television provider, has it also begun to force cable programming companies to re-think their strategy as well?

With HBO’s announcement last week that it would unveil a new monthly streaming subscription service, without the need of a cable TV provider, it has gotten people to ask themselves whether or not they really need cable anymore. Who can blame them? With the great original programming on Netflix, like House of Cards and Orange is the New Black, as well as up-to-date (besides the currently airing seasons) series of other popular television shows like The Walking Dead, Sons of Anarchy and The Following, it seems like a no-brainer for HBO to follow their lead and just charge a monthly subscription fee for those of us who just want to watch Game of Thrones or Boardwalk Empire every Sunday night.

According to an article on Yahoo Finance, Netflix doesn’t see HBO as a competitor looking to encroach on what they’ve created over the past several years, but rather, another player in the internet TV and movie streaming game. It’s no surprise that someone from premium cable realm is finally starting to follow suit. The only real surprise is that it’s taken this long. Few people know that Netflix was actually started in 1997, and has been going by the monthly subscription model (for physical copies of movies) with no late fees since 1999. Granted, their clout in the industry wasn’t as strong then as it is today, but it kept gaining steam. After their initial public offering (IPO) in 2002, and subsequently their online database for streaming, Netflix took off, leaving the likes of Blockbuster and their attempt at a competitive online service in the dust.

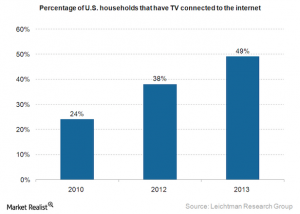

The forecasting research has been done to insist that this trend will likely continue into the future. Take a look at these graphs from the Wall Street Journal and Leichtman Research Group:

Since 2010, while there has been a decline in the number of cable channels being subscribed to, there has also been a significant incline in the amount of households that have at least one TV connected to the internet. While some may say, “those aren’t HBO, or Showtime, or another premium channel, currently you can only get those movie channels as an addition to your pre-existing cable subscription, so the decline in these very basic channels, is actually showing a decline in cable subscribers in general.

So, my questions to you are as follows…

Have you cut the proverbial cord in your television life, or are you just riding the wave until your hand is forced?

Is this move by HBO just the first domino to fall in the eventual elimination of cable TV as we know it today?

Sources:

http://www.businessinsider.com/reed-hastings-netflix-bloomberg-game-changers-2011-5?op=1

http://finance.yahoo.com/news/why-netflix-doesn-t-consider-214814516.html

http://marketrealist.com/2014/10/netflix-influencing-subscriber-loss-media-companies/