There has been tons of speculation recently about the way the most interesting company in the world, known as Apple, is headed. Stock prices fell below $400, an over 40% decline since an all time high last September. The company has not introduced a new product in over six months and it will be at least another three by the time a new one is available in the marketplace. Lastly, competition is rising as the HTC One and Galaxy S4 are slated to be on the market soon which could lead to a decrease of sales of the iPhone. Apple will release its quarterly results next Tuesday April 23rd and the numbers are expected to fall short of Apples quarterly forecast, which will decrease the stock price even more.

prices fell below $400, an over 40% decline since an all time high last September. The company has not introduced a new product in over six months and it will be at least another three by the time a new one is available in the marketplace. Lastly, competition is rising as the HTC One and Galaxy S4 are slated to be on the market soon which could lead to a decrease of sales of the iPhone. Apple will release its quarterly results next Tuesday April 23rd and the numbers are expected to fall short of Apples quarterly forecast, which will decrease the stock price even more.

While there is cause for concern, as with any major corporation, Apple does have many thing to look forward to with one of them being customer loyalty, great management, and near future product releases.

There is not a consumer base out there that are as loyal as Apple consumers. An easy way to prove this is look around any DePaul classroom. First of, the vast majority of students have some a Macbook as their laptop. A greater portion of these students also have an iPhone as their phone. Finally, I would bet that these students also listen to iPods on their morning commutes to school or work. To truly find a company that has better customer loyalty would be a task in itself.

There is not a consumer base out there that are as loyal as Apple consumers. An easy way to prove this is look around any DePaul classroom. First of, the vast majority of students have some a Macbook as their laptop. A greater portion of these students also have an iPhone as their phone. Finally, I would bet that these students also listen to iPods on their morning commutes to school or work. To truly find a company that has better customer loyalty would be a task in itself.

Another reason that Apple will rebound is because they have great management. Many people say that Steve Jobs made the company what it is today. That is true in a way but the support and management around Jobs had to be up to his level as he could not control every part of the company. Apple did not become one of the most valuable companies in the world because of one person.

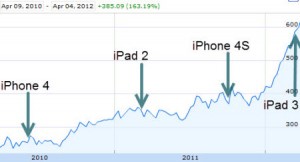

Many investors proclaim that the reason the stock price is falling is because Apple has not released any new products. That is about to change in the upcoming months as there are speculations the new version of the iPhone is slated to come out late this summer. When Apple states the new iPhone release date, that alone will boost stock price. As shown by the image to the right, stock prices increase significantly when a product is released.

As we know, Apple has been one of the most dominating and valuable companies in the world. Recently stock prices have dropped over 40% and sales are predicted to fall short of the quarterly forecast. Many loyal consumers are waiting for the next big thing from Apple but the company is not delivering. What do you think about Apples recent struggles? Has Apple really lost its touch in the market as competition is constantly increasing or will the release of the new iPhone restore Apples value and investor confidence in the company?

Sources

http://www.forbes.com/sites/gregsatell/2013/04/17/whats-going-on-with-apples-stock/

http://www.pcadvisor.co.uk/news/mobile-phone/3436742/iphone-6-release-date/

http://www.forbes.com/sites/rogerdooley/2012/07/17/apple-enemy/