Last Thursday, Microsoft announced that they would be dissolving their current structure and reorganizing. They currently have eight different product divisions, and plan to restructure with four new ones that will be organized around broader functional themes. The main reason for this is to allow for eliminating redundancy and waste, as well as to encourage their nearly 100,000 employees to work more closely with collaborative efforts to build future products. This will make Microsoft look more like its rivals (such as Apple and Google) as an organization – though on a much larger scale – and help it become more competitive in the product areas where it has been losing ground in recent years.

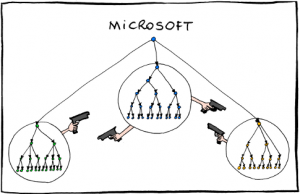

The organizational model used by Microsoft is one that was popularized by Apple (of course), and it focuses on software, hardware, and services rather than individual products or product groups as they had in the past. For example, one executive will be in charge of operating systems now, rather than separate teams developing products like Windows, phones, tablets, and Xbox. In the past, this sparked many rivalries between divisions, and project managers even went to great lengths to avoid dependency on other groups for software, so as to not be “at the mercy of someone else’s development schedule.” This resulted in things like software being developed for one product that had similar functions and features as another existing product. While this should lead to greater efficiencies in product development and can allow better integration among products, it does not address some of the more pressing challenges affecting Microsoft’s current and future revenue stream; for example, as personal computer sales continue to decrease, how does Microsoft plan to adapt its product line?

In my company, we have also begun to realign our departments and personnel around functional groups and are moving away from compartmentalizing each product group within its own line. Is it just coincidence that Microsoft has started doing the same? It certainly is, as Microsoft is the juggernaut of the tech industry and Invivo is a very small subsidiary of a sub-business unit of a division of Philips. In any case, one of the biggest moves came at the end of last week, when it was announced that our already small marketing department would be losing a few members, and everyone else was reorganizing into functional groups where everyone would cover the full product line as it fell under their area of responsibility. As some of our other departments and developers have also realigned similarly, I hope that it will do for us what Microsoft hopes it does for them – increase efficiency and effectiveness.

In light of the above, is your company more like old Microsoft or new Microsoft? If like “old”, do you find that project managers often butt heads with other departments on which they have dependence for aspects of their products or projects? If like “new” do you find that aligning by function rather than products yields better results?