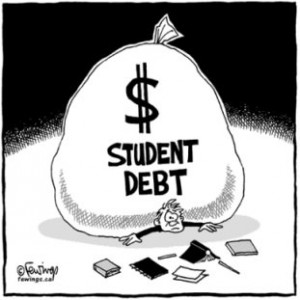

Quality is an important factor when producing goods and services. Each organization sets its own quality standards based on customers’ demands and needs. If we look at quality from the customers’ perspective we will want to have products that we can rely on when using them, otherwise if the product is defective we might want to stop using it. On the manufacturers’ perspective if the customers are unsure of quality on their products, it is their job to make the necessary adjustments to make the product attractive to the customer again. When the situation is created by defect on fabrication it can mean big amount of money losses for the manufacturer, therefore it should work on fixing the defects as soon as these are detected in order to avoid bigger losses and not get their reputation hurt.

An example of a company restoring confidence in its product is Boeing and the battery problems that its passenger jet 787s has been facing since January and that it cost them to stop flying them. According to an article in the New York Times by Christopher Drew and Jad Mouawad, the Federal Aviation Administration approved in April the company’s plan to fix the batteries of 50 jets that where delivered at that time. The authors explain that the lithium-ion batteries problems were detected when two of them had overheated in two different jets. As soon as the problem was detected its engineers worked on finding the causes of the defective batteries and the best approach to fix it. Collection of data was necessary to support the changes and come up with a plan. Luckily, the 800 orders that were already planned for the plane were not affected, the authors explain, since it promised a 20 percent fuel savings. After collecting data and analyzing it, the company decided to send several technicians around the world to fix the batteries and install the new system which includes better insulation and other features to prevent batteries incidents (Drew and Mouawad). The article goes on by explaining that even after this efforts by the company to fix the problem, Japanese airlines have asked for more assurance that the incidents will not be likely to happen again or at least detected by introducing monitoring systems for the batteries that would send information about the batteries conditions and replacement of them every certain time period. All this efforts are done in order to recover the customer’s confidence.

We can see in this example how a defect might represents serious consequences in the company’s reputation and generate monetary losses. This illustrates the importance of having systems that monitor the quality and processes on production and if problems are presented look for the causes and fix them as soon as possible.

Do you think Boeing’s approach to solve the problem was appropriate? Should the company provide monitoring systems that Japanese airlines demand or do you think is enough just by replacing the batteries and the insulation system implemented?

There are many pros and cons of the renovation plan. Some thoughts that should be considered are the local businesses – will having more Wrigley restaurants and a hotel take away from local businesses? More importantly, how will the jumbotron affect the rooftops since they bring revenue to the owners and to the city as well?

There are many pros and cons of the renovation plan. Some thoughts that should be considered are the local businesses – will having more Wrigley restaurants and a hotel take away from local businesses? More importantly, how will the jumbotron affect the rooftops since they bring revenue to the owners and to the city as well?