Im sure many of you have heard of the terrible explosion that rocked the small town of West, Texas early this week injuring over 150 and killing at least 14. What many of you probably dont know, are the reasons behind why such a thing could happen. As it turns out the plant, which manufactures ammonium nitrate, a type of fertilize that was used in the Oklahoma City bombings in 1995, had no firewalls or sprinkler systems. Being as small as it was, the plant did not attract the attention of big government agencies and when it did, penalties where few and far between.

Problems started occurring last summer when the U.S. Pipeline and Hazardous Materials Safety Administration assessed a $10,000 fine against West for improperly labeling storage tanks and preparing to transfer chemicals without a security plan. The company was then only forced to pay $5,250 after reporting it had corrected the problems.The U.S. EPA also cited the plant for not having an up-to-date risk management plan. That problem was also resolved, and the company submitted a new plan in 2011. That plan, however, said the company did not believe it was storing or handling any flammable substances, and didn’t list fire or an explosion as a danger (Herald 1). There are many more situations like this, the plant has also been cited for not having the proper safety equipment in place for transporting flammable chemicals.

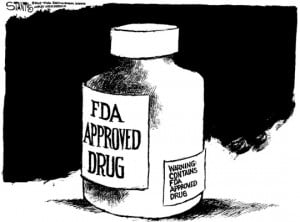

This story comes down to two things, lack of regulation, and disregard of management. We always hear in the news how companies are complaining of over regulation by the government. Saying that government is hindering their growth and profitability. It seems to me however that government needs to be more involved. How can a plant, that is built less than a mile from both a school and nursing home, not be required to have any fire safety equipment, especially when it essentially manufactures bomb making chemicals? Also, how can there be violation after violation with a only a $5,000 fine being imposed? I can’t put the full blame on the government though, management also has major blame here. There job is to handle all production aspects and make sure everything is produced both profitable and ethically. I think they chose to maximize profits and not care at all about the well being of their employees. They were to cheap to buy safety equipment and didn’t even want to bother to come up with a risk management plan. Now they have at least 14 deaths and over 150 injured, along with the town and their plant being destroyed.

I think this story shows us that profits aren’t everything and that doing the bare minimum, when it comes to safety standards is not the right thing to do. This proves that management is a very important part of the company and doesn’t only deal with day to day operations, but also with peoples lives.

Sources

“Little Regulation for Small Fertilizer Plants.” The Daily Herald. N.p., n.d. Web. 21 Apr. 2013. <http://www.heraldnet.com/article/20130421/NEWS02/704219901>.