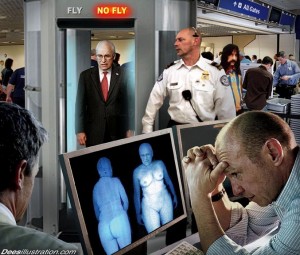

Recently, I went to L.A. When I was waiting at security checkpoint, the U.S Custom officer asked me to do the full-body scanners. That was not my first time to do this; I could not count the times that I have been to this situation. However, I have read an article about this controversial issue that how to led entrepreneur Marc Carey to launch a line of airport underwear for men, women and children. His company, Kentucky based ScannerShirts.com, markets underwear with smiley faces and patriotic symbols like stats and the U.S seal, strategically placed to obscure private parts if the wearer must do the full-body scan. I am wondering, is it ethical to market merchandise that aims to thwart government-mandated initiatives like full-body scans at airports?

However, there are some pros and cons in this issue:

Pro: Full-body scans are revealing invasive and undignified; moreover, merchandise like airport underwear does not prevent security personnel from adequately screening travelers for prohibited devices.

Con: Scanning requires only that travelers stand in a screening room, fully clothed for only 15-25 seconds. Experts claim the extremely low dose of radiation poses no health threat. Furthermore, an item like airport underwear provokes consumers’ worst fears about inappropriate contact.

Therefore, given the circumstances, consumers need to exercise their own good judgment about whether to purchase special travel underwear.

What do you think?

Sources:Fran Golden,”Airport Scanner Blocking Underwear a Hit,” AOL Travel, January 5,2011.