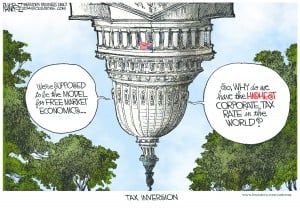

These past few weeks an important topic drew the public’s attention about American corporations. Largely it has initiated a hot and emotional debate on the current political paradigm. A significant discussion is on companies’ tax-inversion. This is the practice of purchasing foreign company, and claiming that the company was a “parent” company. This way the “investor” is no longer obligated to pay U.S. income tax on any revenue made outside of the country. As a result, more organizations are taking advantage on tax avoidance. Due to these complaints President Obama and his administration is imposing new rules to oppose and disallow these loopholes.

Many fortune 500 organizations are considering this option. Recently Burger King, made headlines when they are trying to move their headquarters to Canada from Florida. They are working on purchasing the largest fast food service, Tim Hortons, Inc. which is based in Canada.

In management class we have learned that efficiency and effectiveness are some of the major keys in organization’s performance, as well as their ethical outlook. As a customers, we support businesses that have strong reputation and those companies that invest and contribute to the community well-being.

Today’s economy is very volatile and competitive place to do business in. Majority of large American companies are global, and they need competent people that are capable of tackling different issues to be productive and innovated. To achieve a greater goal you need also a great leadership; managers who must understand others, make responsible choices, and take proper actions to achieve the desired objectives.

I understand the frustration of people complaining about companies changing their “citizenship,” and consequently avoiding paying taxes on non-U.S. profits. Also, I do understand the government administration is trying to protect self-interests as they are losing revenue. However, when comparing the US with other developed countries, United States has one of the highest corporate tax rate. If businesses continue to pay high rates, they will be looking for other alternative methods to save money and as a result they will be unable to reinvest more in our people and our communities.

Instead of punishing companies that are moving abroad to avoid paying taxes, the government should try to lower the tax rate and encourage organizations to return and create more jobs back home.

Someone may say that tax inversion loophole creates incentives for companies to put their self-interest above others and act unethical. From the stockholders perspective at the end of a day the most essential goal is to accelerate and satisfy returns on investments to shareholders.

Do you think companies should continue taking advantage on tax inversion? Or should they receive tax benefit and expand their operations right here in U.S.? How about the ethical issues? What behavior is appropriate or inappropriate for organizations?

http://en.wikipedia.org/wiki/Tax_inversion

http://en.wikipedia.org/wiki/Tim_Hortons

http://www.philly.com/philly/business/20141029_Pfizer_CEO__still_exploring__tax_inversion__tactic.html

http://ourfuture.org/20140923/administrations-new-rules-for-companies-renouncing-citizenship

http://www.opednews.com/articles/Tax-Dodging-Deal-Fails-Tha-by-Dave-Johnson-Corporations_Politicians_Taxes-141102-630.html

You bring up a great topic. It’s unfortunate how these big corporations are all running away to other countries to save money while depending on us costumers to generate revenue. I personally don’t think corporations are taxed enough. I wish costumers would just boycott these companies and show them that there is power in consumerism. I guarantee you at that point they would rethink their strategy without even being forced by the us government.